Two of the most common pieces of financial advice you’ll hear is to avoid debt and, if you are in debt, to pay it off as quickly as you can. But that’s easier said than done.

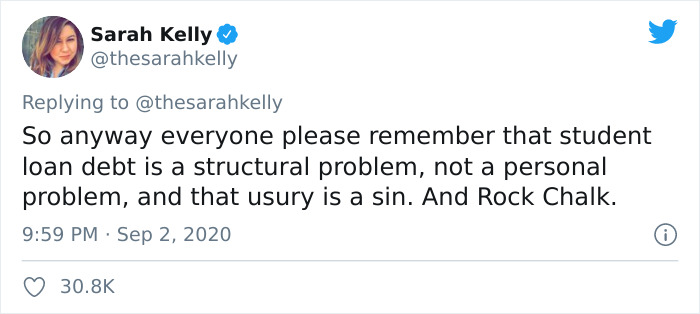

Student loan debt in 2020 is around 1.6 trillion dollars and there are around 45 million borrowers in the United States alone, according to Forbes. Student loan debt is such a huge problem that Sports Illustrated editor Sarah Kelly drew attention to it by sharing her personal experience in a recent Twitter thread.

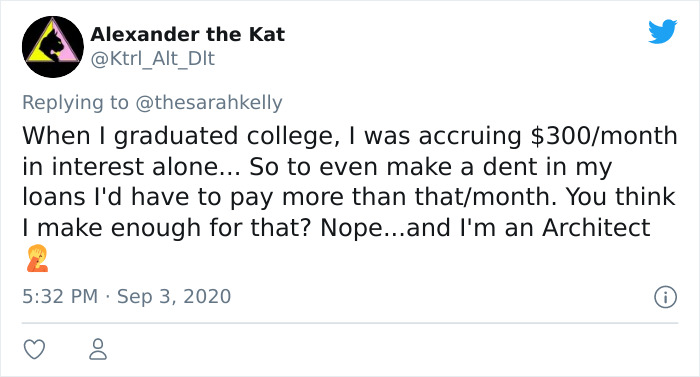

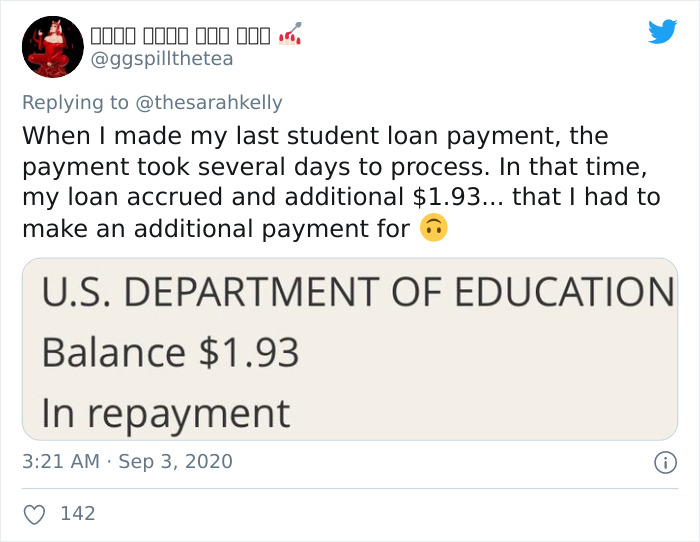

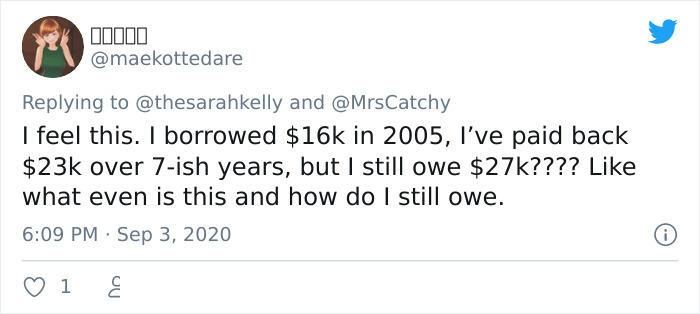

It went viral, as other Twitter users rushed to talk about their own student loan horror stories and just how predatory the system can be.

Sarah Kelly’s shared her thoughts about the American student loan system in a viral Twitter thread

Image credits: thesarahkelly

Image credits: thesarahkelly

Image credits: thesarahkelly

Image credits: thesarahkelly

Image credits: thesarahkelly

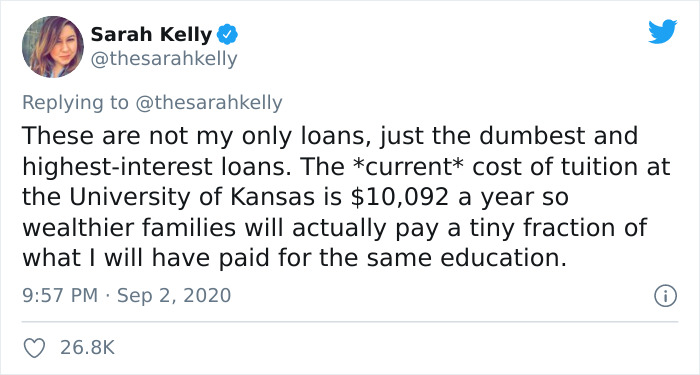

Kelly drew attention to the idea that families that can afford to pay their children’s tuition might actually end up paying less than the people who take out loans to finance their studies. Her words reached a lot of people: 362.8k liked what she had to say and 55.5k retweeted her message.

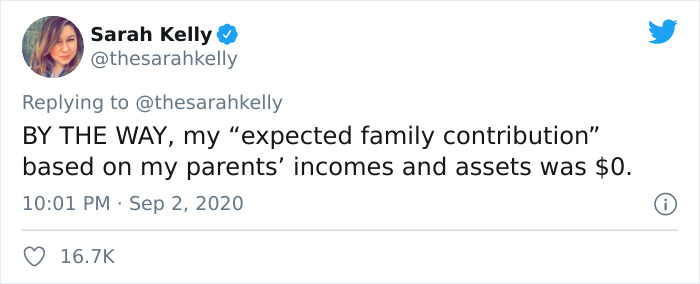

US student loan debt is the second-highest consumer debt category in the country, right behind mortgage debt but ahead of credit card and auto loans. The Institute for College Access and Success states that the average student debt of Americans who graduated in 2018 was 29.2k dollars. And that’s just the average!

Whether we like it or not, college is getting more expensive. The cost of a 4-year degree has increased by 25 percent while student debt has risen by 107% since the 2008 recession.

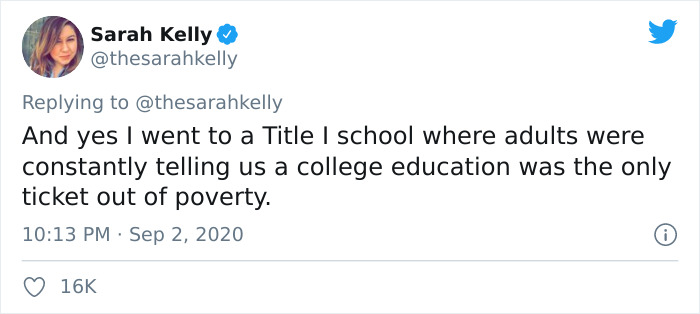

However, not going to college is not an option for some high school graduates. CNBC reports that those who have a college degree earn on average 80 percent more than people with just a high school diploma.

So going to college means investing in your future, but it can also mean going into debt. So it’s a tough choice to make, especially during the coronavirus pandemic which has put a lot of pressure on not just the US but also other countries’ economies.

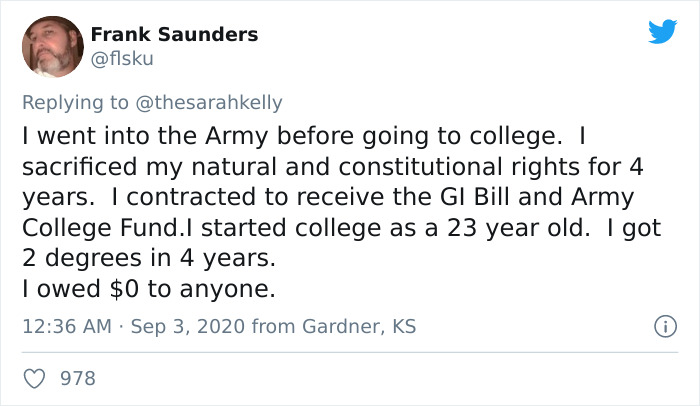

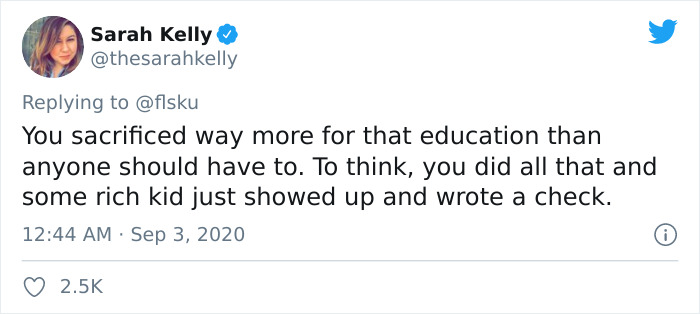

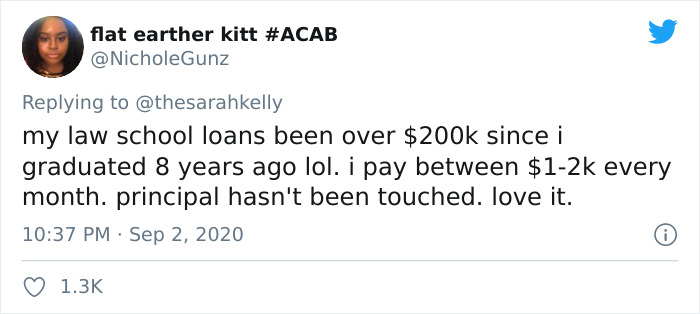

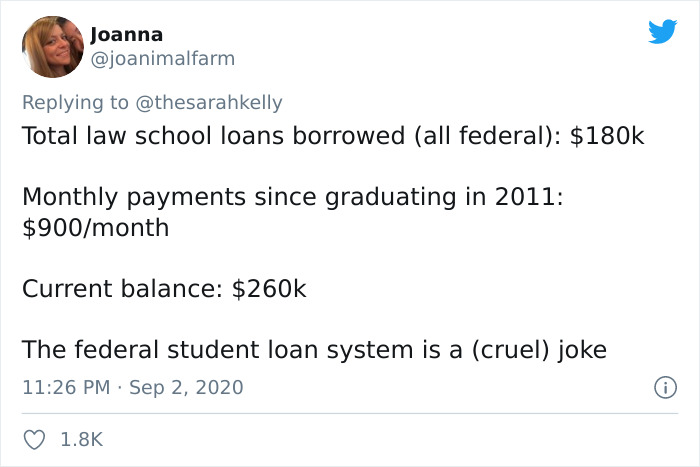

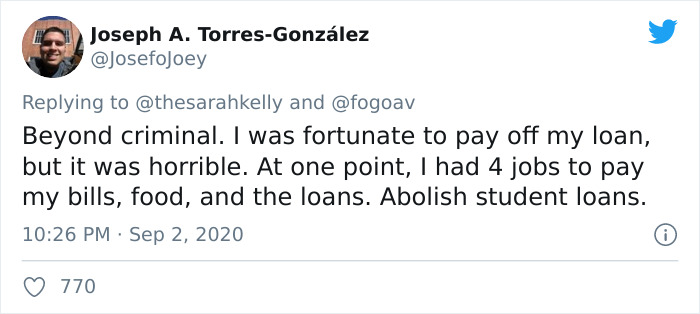

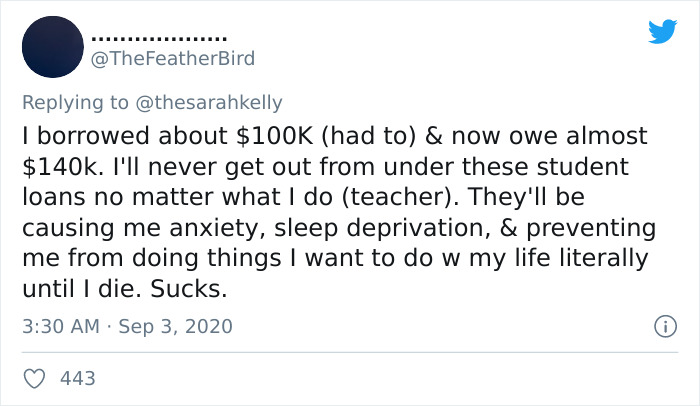

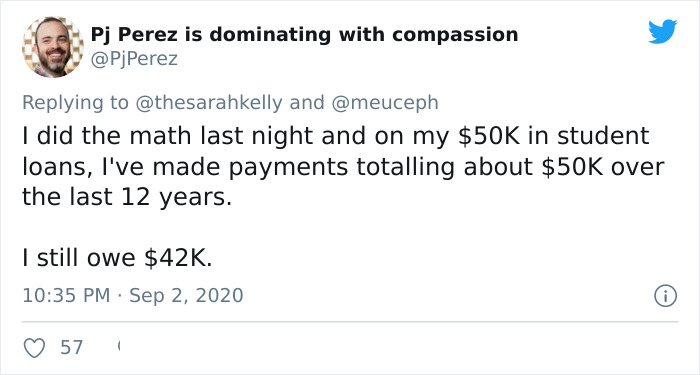

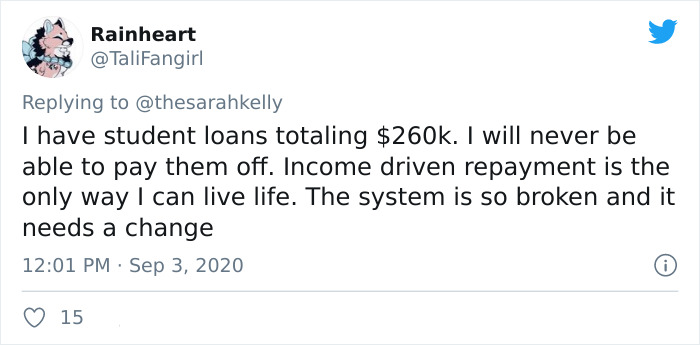

Other people shared their thoughts about student loans in the US as well

Image credits: flsku

Image credits: thesarahkelly

Image credits: joanimalfarm

Image credits: JosefoJoey

Image credits: TheFeatherBird

Image credits: PjPerez

Image credits: TaliFangirl

Image credits: thesarahkelly

Image credits: Ktrl_Alt_Dlt

Image credits: cameronjae123

Image credits: ggspillthetea

Image credits: MaJaPe

Image credits: maekottedare

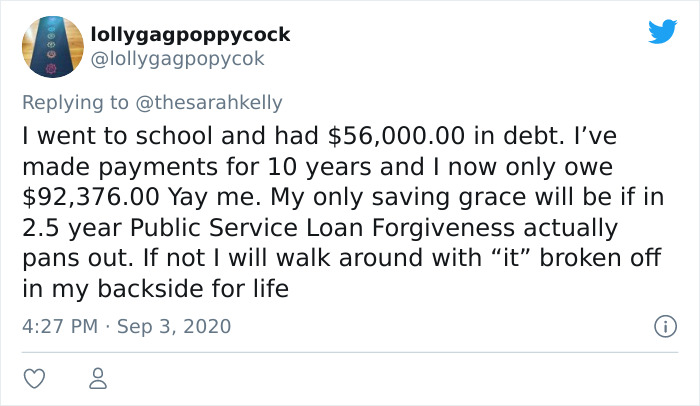

Image credits: lollygagpopycok

Image credits: VicVijayakumar

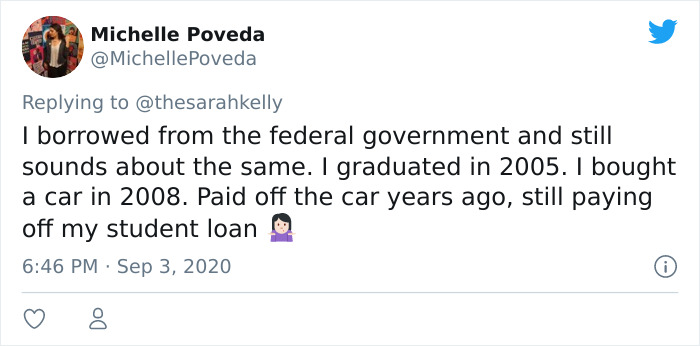

Image credits: MichellePoveda

Image credits: oureyesopen

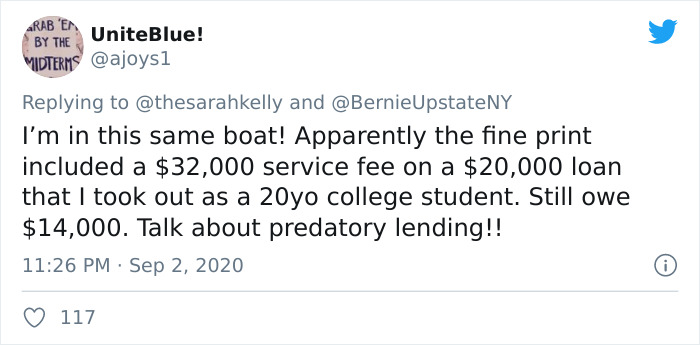

Image credits: ajoys1

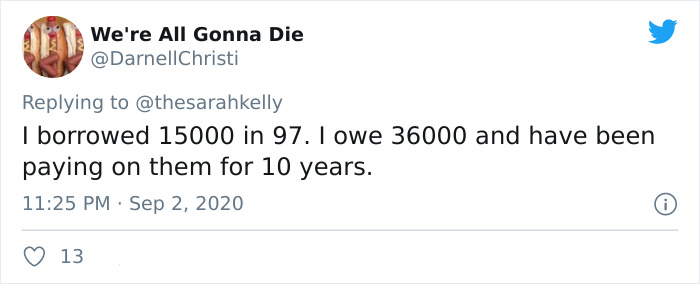

Image credits: DarnellChristi

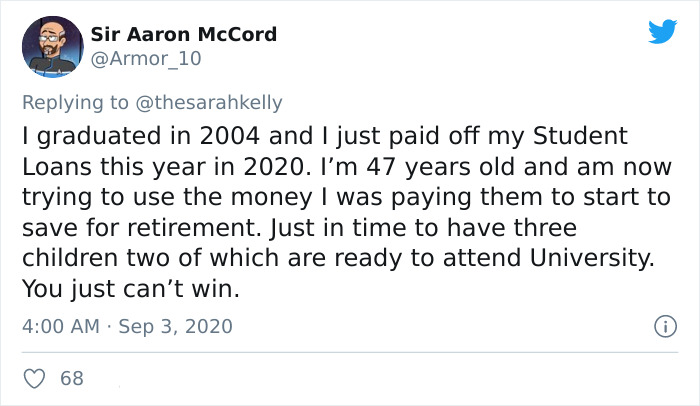

Image credits: Armor_10

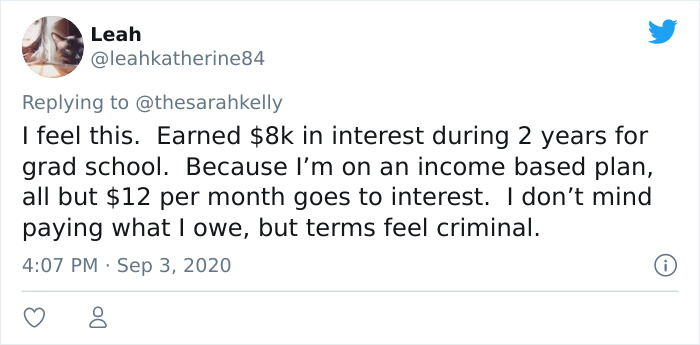

Image credits: leahkatherine84

Image credits: brownstown1217

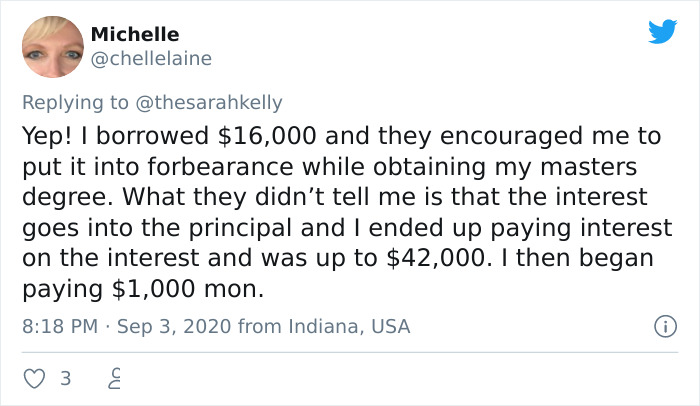

Image credits: chellelaine

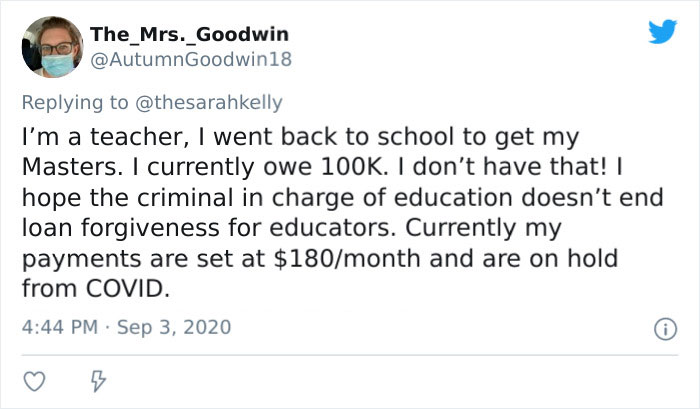

Image credits: AutumnGoodwin18

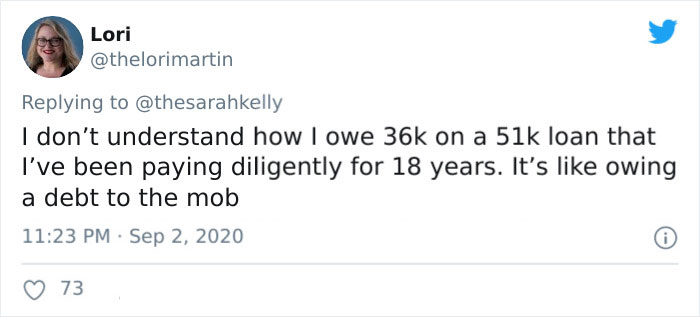

Image credits: thelorimartin

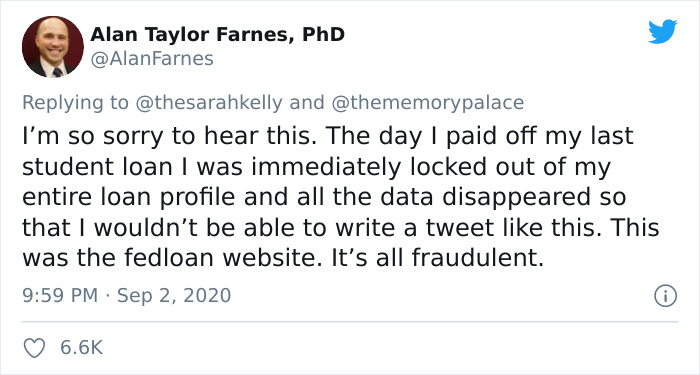

Image credits: AlanFarnes

Image credits: leftistchicano

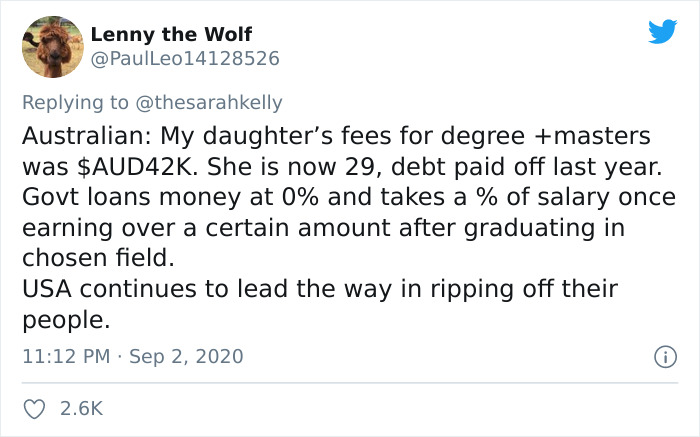

Image credits: PaulLeo14128526

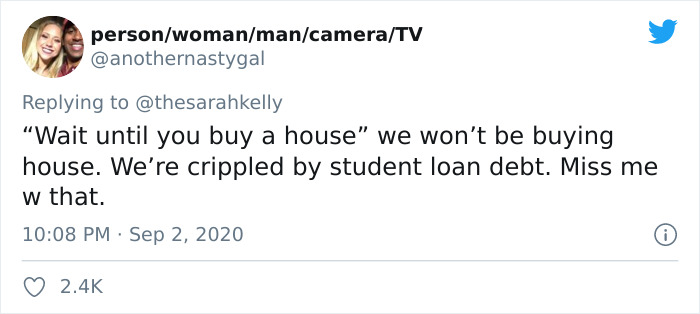

Image credits: anothernastygal

Image credits: anamerican_iam

26 People Are Sharing Stories Of Their Modern Burden – Student Loans

![26 People Are Sharing Stories Of Their Modern Burden – Student Loans]() Reviewed by CUZZ BLUE

on

September 08, 2020

Rating:

Reviewed by CUZZ BLUE

on

September 08, 2020

Rating:

We should all suffer equally for these people's bad financial judgement. If not for government intrusion, they could file for bankruptcy, thanks Barry!

ReplyDelete